Insulation & Air Sealing Program

Focus on Energy is Wisconsin’s energy efficiency and renewable resource. This statewide organization provides information, resources, and generous financial incentives to eligible Wisconsin customers of participating utility companies by offering energy efficiency and renewable energy programs that otherwise wouldn’t happen, or in some cases years sooner than scheduled.

Since 2011, Focus on Energy has realized more than $1 billion worth of net economic benefits to Wisconsin. By eliminating energy waste, the need to purchase coal and natural gas from other states is substantially reduced. This keeps dollars and jobs in Wisconsin and lessens the need to build additional power plants.

Insulation and air sealing are some of the most important and beneficial improvements you can make to your home. They lower energy costs while keeping the home warmer in the winter and cooler in the summer. These upgrades can also solve common home issues like condensation, ice dams, and poor indoor air quality.

Why Insulation & Air Sealing?

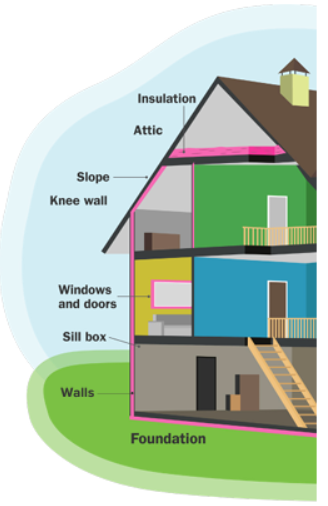

Properly insulating your home is one of the most basic and important steps you can take to achieve year-round comfort and lower your energy costs. Most older homes—and newer homes, too—can benefit from additional insulation in the attic, exterior walls, overhangs, sill boxes, or the foundation. For even greater results, insulate and seal air leaks at the same time. It is a strategy that works to prevent wasted energy and money from slipping through the cracks, and it quickly pays for itself in reduced utility bills. Insulation slows down the movement of heat, keeping it where you want it. That means out in the summertime, and in during the chilly winter months.

Air sealing works to prevent air leakage, a common dilemma that puts an extra burden on your heating and cooling systems and makes it harder and more expensive to maintain comfort. The typical trouble spots include attics, interior walls, electrical outlets, and light fixtures—areas where it is easy for warm air to escape into your home. A smart combination of insulation and air sealing is the ideal prescription to combat the issue, boost comfort, and improve home performance.

Download Insulation and Air Sealing Program Overview (pdf)

Benefits of Insulation

- Increased comfort

- Lower utility costs

- Less noise

Benefits of Air Sealing

- Greater comfort

- Lower utility costs

- Fewer drafts

- Less pollen and dust

- Prevention of ice dams

- Humidity control

Common Households Leaks

- Behind knee walls

- Attic hatch

- Wiring holes

- Plumbing vents

- Recessed lights

- Furnace flue or duct chaseways

- Basement rim joists

- Windows and doors

Rebates

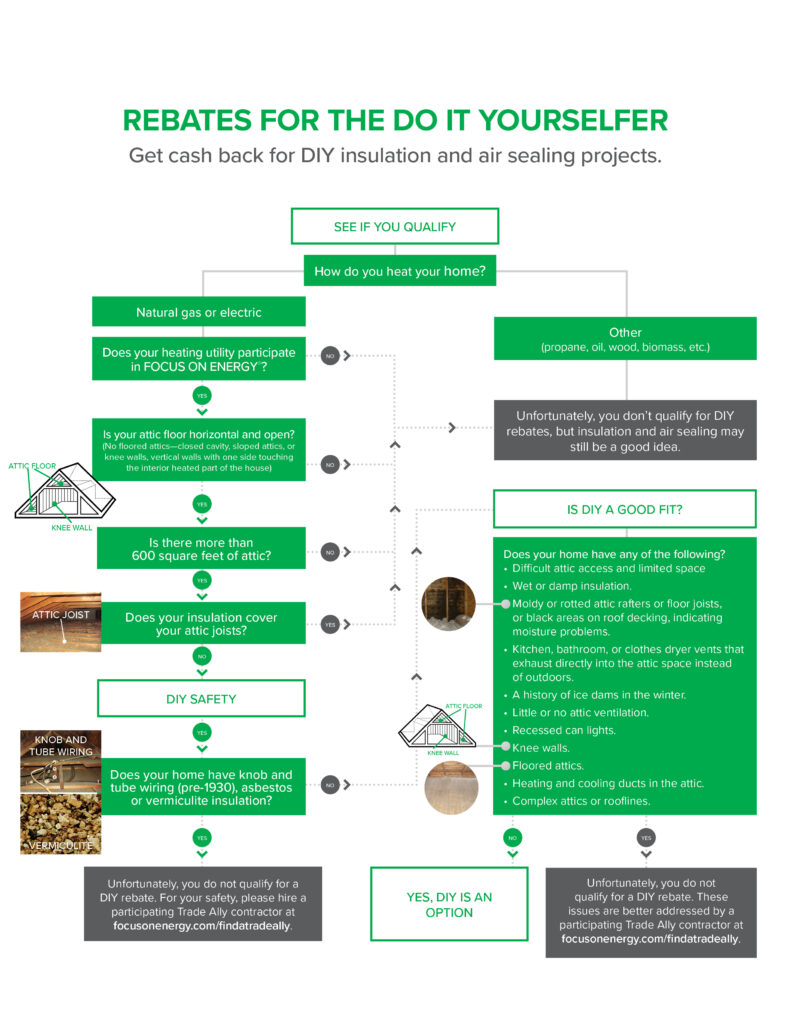

The program offers two installation options: Professionally Installed and Do It Yourself (DIY).

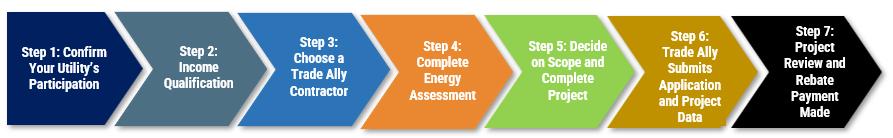

- Professionally Installed: Only certified Focus on Energy Trade Ally contractors can install and offer these higher Focus on Energy rebates. NOTE: Home Energy Solutions of Wisconsin has meet the required requirements and submitted the necessary documentation & certifications to be a qualified Focus on Energy Trade Ally contractor. A Home Energy Assessment is required for both rebate levels.

- This option has two rebate levels.

- Standard Rebates: Available for moderate to high income households.

- Income-Qualified Rebates: Available for households at or below 80% of the Area Median Income for their county and household size. Households must be pre-qualified prior to participation.

- Download Program Overview (pdf)

- This option has two rebate levels.

- Do It Yourself: Focus on Energy offers $200 cash back for self-installed attic insulation and air sealing.

- Before committing to a DIY project, confirm your home is a good fit (see below).

Focus on Energy programs are available to customers of participating utility companies (see list below). NOTE: Some programs require that a resident must be a customer of a participating natural gas AND electric utility.

Complete Program Requirements / Complete Installation Requirements

Participating Utility Companies (Current as of January 1, 2024)

- Adams-Columbia Electric Cooperative

- Algoma Utilities

- Alliant Energy (Wisconsin Power & Light)

- Arcadia Electric Utility

- Argyle Electric & Water Utility

- Bangor Municipal Utility

- Barron Light & Water

- Belmont Municipal Light & Water

- Benton Electric & Water Utility

- Black Earth Electric Utility

- Black River Falls Municipal Utilities

- Bloomer Electric & Water Utility

- Boscobel Utilities

- Brodhead Water & Light

- Cadott Light & Water Department

- Cashton Light & Water

- Cedarburg Light & Water

- City Gas Company

- Clark Electric Cooperative

- Clintonville Utilities

- Columbus Water & Light

- Consolidated Water Power Company

- Cornell Municipal Light Department

- Cuba City Light & Water

- Cumberland Municipal Utility

- Dahlberg Light & Power Company

- Eagle River Light & Water Utility

- Eau Claire Energy Cooperative

- Elkhorn Light & Water

- Elroy Electric & Water Utility

- Evansville Water & Light

- Fennimore Municipal Utility

- Florence Utilities (Electric Only)*

- Gresham Water & Electric Plant

- Hartford Electric

- Hazel Green Light & Water Utility

- Hustisford Utilities

- Jefferson Utilities

- Juneau Utilities

- Kaukauna Utilities

- Kiel Utilities

- La Farge Municipal Utilities

- Lake Mills Light & Water

- Lodi Utilities

- Manitowoc Public Utilities

- Marshfield Utilities

- Mazomanie Electric Utility

- Medford Electric Utility

- Menasha Utilities

- Merrillan Electric & Water Utility

- MGE (Madison Gas & Electric)

- Midwest Natural Gas, Inc.

- Mount Horeb Utilities

- Muscoda Utilities

- New Glarus Utilities

- New Holstein Utilities

- New Lisbon Municipal Light & Water

- New London Utilities

- New Richmond Utilities

- North Central Power Co. Inc.

- Northwestern Wisconsin Electric Company

- Oakdale Electric Cooperative

- Oconomowoc Utilities

- Oconto Electric Cooperative

- Oconto Falls Municipal Utilities

- Pardeeville Public Utilities

- Pierce Pepin Cooperative Services

- Pioneer Power & Light Co.

- Plymouth Utilities

- Prairie du Sac Utilities

- Princeton Light & Water Department

- Reedsburg Utility Commission

- Rice Lake Utilities

- Richland Center Utilities

- Richland Electric Cooperative

- River Falls Municipal Utilities

- Rock Energy Cooperative

- Sauk City Utilities

- Scenic Rivers Energy Cooperative

- Shawano Municipal Utilities

- Sheboygan Falls Utilities

- Shullsburg Electric Utility

- Slinger Utilities

- Spooner Municipal Electric Utility

- St. Croix Gas

- Stoughton Utilities

- Stratford Water & Electric Department

- Sturgeon Bay Utilities

- Sun Prairie Utilities

- Superior Water, Light & Power

- Taylor Electric Cooperative

- Trempealeau Municipal Utilities

- Two Rivers Utilities

- Vernon Electric Cooperative

- Viola Municipal Electric Utility

- Waterloo Utilities

- Waunakee Utilities

- Waupun Utilities

- We Energies

- Westby Utilities

- Westfield Electric Company

- Whitehall Electric Utility

- Wisconsin Dells Water & Light Utility

- Wisconsin Rapids Water Works & Lighting Commission

- Wonewoc Water & Light Department

- WPS (Wisconsin Public Service)

- Xcel Energy (Northern States Power)

*Florence Utilities customers are eligible for Focus rebates and incentives related to improvements that reduce their electric energy usage and for renewable energy rebates. Florence Utilities customers are not eligible for Focus rebates and incentives related to improvements that reduce their natural gas usage.

Insulation and Air Sealing Program

SINGLE-FAMILY REBATES (1-3 Units)

| Insulation / Air Sealing Improvement | Standard Rebate | Income-Qualified Rebate |

|---|---|---|

| ENERGY STAR® Qualified Air Sealing Energy Assessment Required* | $675 | $1,125 |

| Attic Insulation | $525 | $675 |

| Sill Box Insulation | $75 | $110 |

| Foundation Insulation | $75 | $110 |

| Wall Insulation | $450 | $450 |

| Duct Sealing & Insulation | $75 | $75 |

| Verified Duct Sealing & Insulation | $150 | $150 |

| DIY Attic Insulation & Air Sealing | $200 | $200 |

Rebates effective for improvements made on or after July 1, 2024, Incentives may change or discontinue without notice. *Must be completed along with Trade Ally contractor installed attic or wall insulation improvements. Please review the Program Requirements tab for full participation requirements.

MULTIFAMILY REBATES (4+ Units)

| Insulation & Air Sealing Improvement | Rebate Amount |

|---|---|

| Air Sealing & Attic Insulation, Existing < R-11 | $1.00 per sq. ft. of attic space |

| Air Sealing & Attic Insulation, Existing R-12 to R-19 | $.70 per sq. ft. of attic space |

| Air Sealing & Attic Insulation, Existing R-20 to R-38 | $.55 per sq. ft. of attic space |

| Exterior Wall Insulation, Existing < R-5 | $.80 per sq. ft. of wall area improved |

Rebates effective for improvements made on or after July 1, 2024, Incentives may change or discontinue without notice.

Vermiculite

- What is Vermiculite? (pdf)

25C Insulation Tax Credit

The 25C Insulation Tax Credit, also called the Energy Efficient Home Improvement Credit, allows eligible homeowners to receive a federal tax credit of up to $1,200 annually for upgrades like insulation and air sealing.

Unfortunately, this tax credit will be eliminated at the end of 2025, and you’ll need to act fast if you want to take advantage. Home Energy Solutions can help ensure that your work qualifies. Reach out today to see how much you could save with the insulation tax credit and other available incentives and rebates.

Warning: The Insulation Tax Credit Expires at the End of 2025!

Although the insulation tax credit was originally intended to run through 2032, a new law passed this year eliminates the tax credit early. This means that you only have a few months left to claim your savings! Your insulation upgrades must be completed on or before December 31, 2025 in order to qualify, and our schedule is filling up fast. If you want to save money when you upgrade your home, reach out to Home Energy Solutions today to book your appointment.

What Is a Tax Credit?

Homeowners sometimes ask us if home insulation is tax deductible. Tax credits and tax deductions are similar tax breaks, but they’re not the same. A tax credit reduces the amount of taxes you owe, while a tax deduction reduces your total taxable income. The insulation tax credit only applies to federal taxes, not state taxes.

Benefits of the 25C Tax Credit for Insulation and Air Sealing

Taking advantage of the insulation tax credit means that you’ll see all of the benefits of improving the energy efficiency of your home: lower energy bills, improved home comfort, and a house that’s better for the environment. But there are additional benefits unique to this specific tax credit:

The Insulation Tax Credit or Energy Efficient Home Improvement Credit is:

Available to Anyone With Federal Tax Liability: If you pay federal taxes, you can claim your insulation tax credit! This is a national incentive available to any homeowner, unlike many rebate programs.

Can Be Combined With Other Incentives and Insulation Rebates: But if you do qualify for other incentives, the 25C tax credit is a great opportunity for additional savings, making upgrading your home even more affordable.

$150 Credit for Energy Audits: If your eligible tax credit for insulation and air sealing work doesn’t reach the $1,200 annual maximum, you can also take a 30% credit—with a limit of $150—for any energy audit related costs.

Calculated Separately From Heat Pump Upgrades: The 25C homeowner tax credit covers a number of different energy-efficiency upgrades for your home, and insulation and air sealing upgrades are in a separate category from heat pump HVAC systems and heat pump water heaters. This means that you can take both a $1,200 insulation tax credit and a $2,000 heat pump tax credit in the same year, for as much as $3,200 in total tax credit savings.

How Does the 25C Insulation Tax Credit Work?

The 25C tax credit (25C refers to the relevant section of the IRS tax code) allows you to take a federal tax credit equaling 30% of the total cost for a variety of energy efficiency home upgrades, including qualifying insulation and air sealing expenses. There is an annual maximum credit of $1,200 for the category of upgrades that includes insulation.

Attic insulation, wall insulation, basement insulation, and crawl space insulation all qualify for the credit, as do many different types of insulation materials, as long as certain insulation levels are met. Home Energy Solutions will work with you to ensure that your insulation work is eligible.

How to Claim Your Tax Credit

Claiming your tax credit for insulation and air sealing upgrades is straightforward:

- Schedule Work Before 2026! This tax credit is ending early, and your upgrades need to be completed on or before December 31, 2025.

- Verify Eligibility: Home Energy Solutions will verify with you that the insulation work we’ve done for you meets the criteria for tax credit eligibility.

- Keep Your Receipts: We will also provide you with an invoice breaking down the tax-credit-eligible portion of your work. You’ll need this when you or your accountant goes to file your taxes for the year in which work was done on your home.

- File IRS Form 5695 or consult a Tax Professional:* When you file your taxes, remember your tax credit!

*At Home Energy Solutions, we have a tax professional prepare our taxes, and recommend that you do, too. Our goal is to be as helpful as possible in ensuring you get your tax credit, but we’re experts in insulation, not taxes!

With the 25C Insulation Tax Credit / Energy Efficient Home Improvement Credit you can save up to $1,200 in tax credits when you insulate your home with Home Energy Solutions.

$150 Credit for Energy Audits: If your eligible tax credit for insulation and air sealing work doesn’t reach the $1,200 annual maximum, you can also take a 30% credit—with a limit of $150—for any energy audit related costs.

These tax credits can be combined with other incentives and insulation rebates: But if you do qualify for other incentives, the 25C tax credit is a great opportunity for additional savings, making upgrading your home even more affordable.